SMIC increases production as China faces expanding AI chip tightening

According to reports, after suggesting that state supported data centers only use domestically produced artificial intelligence chips (effectively excluding Nvidia), China may now face a deepening shortage of chip production capacity. According to The Wall Street Journal, the shortage has become so severe that authorities are rationing SMIC's production and shifting its limited capacity towards China's AI flagship.

The report points out that China's chip production is still difficult to determine, but even the most optimistic forecast is far behind domestic demand. The Wall Street Journal quoted former Biden administration official Saif Khan, who was involved in export controls, as saying that even if China multiplies its production estimate by five times, it still cannot meet domestic demand.

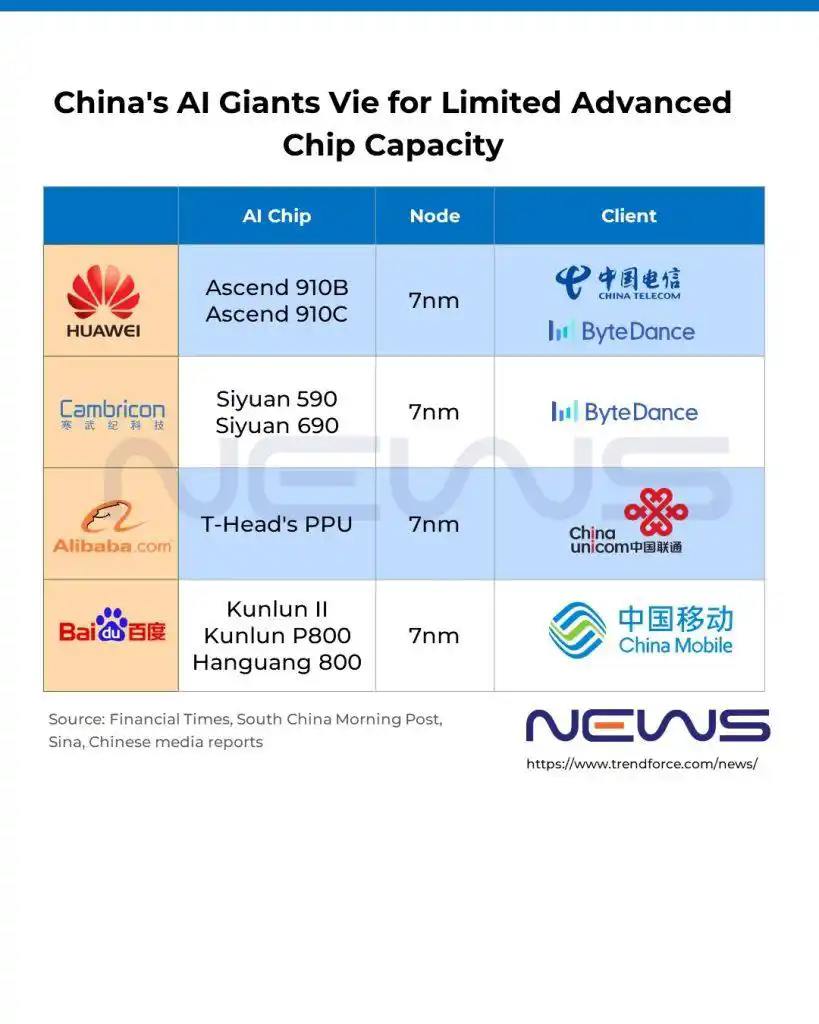

Huawei and startups compete to meet the surging demand for artificial intelligence

Amidst the soaring demand for artificial intelligence training in domestic data centers, The Wall Street Journal reports that chip manufacturers are scrambling to meet this load. For example, Huawei is combining thousands of chips into large, power consuming systems to support artificial intelligence workloads. According to Tom's Hardware, the company first launched CloudMatrix 384 at the 2025 World Artificial Intelligence Conference (WAIC) in 384 months. This is a rack level artificial intelligence system equipped with 384 Ascend 910C processors, connected through all-optical, all to many mesh networks, designed to compete with NVIDIA.

Although major chip manufacturers have retained domestic contract manufacturing capacity, the Wall Street Journal reported that Chinese artificial intelligence startups such as MetaX, headquartered in Shanghai, are turning to older and more accessible technologies - connecting multiple smaller chips to compensate for limited computing power. However, this solution has a drawback: these multi chip setups are very power consuming and can significantly increase power consumption. As the Financial Times pointed out at the beginning of November, local governments are taking incentive measures to help technology giants such as ByteDance, Alibaba and Tencent cope with the soaring power costs after Beijing banned NVIDIA AI chips.

The utilization rate of contract factories has increased

In the context of soaring demand for artificial intelligence and tight chip supply, the utilization rates of China's two major foundries, SMIC and Huahong, have risen. The second quarter financial report released by SMIC shows a yield of 92.5%, an increase of 2.9 percentage points from the first quarter and a year-on-year increase of 7.3 percentage points, as the company will announce its third quarter results this Friday. At the same time, Huahong's utilization rate further increased, rising from a record 108.3% in the second quarter to 109.5% in the third quarter.